FIFO stands for “First In, First Out.” This inventory management method assumes that the first items added to inventory are the first to be sold or used. Essentially, it prioritizes the sale of older inventory before newer stock. This approach is particularly beneficial in industries where products have a limited shelf life, such as food and pharmaceuticals, as it minimizes the risk of spoilage and obsolescence. The FIFO method is not a suitable measure when you have inventory purchases or production with fluctuating prices. Inaccurately stated profits will often appear for the same period because you have different costs recorded for the same goods during that matching period. FIFO shows your true gross and net profits in times of increasing inventory prices.

Simplified Cost Calculation

Each time inventory is purchased, the cost is recorded and added to the inventory account. This requires meticulous record-keeping to ensure that the oldest costs are used first. By assigning the oldest costs to COGS, FIFO typically results in lower COGS during periods of rising prices.

- The weighted average cost method calculates COGS and ending inventory based on the average cost of all units available for sale during the period.

- When a sale occurs, the system identifies the oldest stock and deducts that amount from inventory.

- As LIFO is the opposite of FIFO, it typically results in higher recorded COGS and lower recorded ending inventory value, making recorded profits seem smaller.

- And companies are required by law to state which accounting method they used in their published financials.

- In addition to being allowable by both IFRS and GAAP users, the FIFO inventory method may require greater consideration when selecting an inventory method.

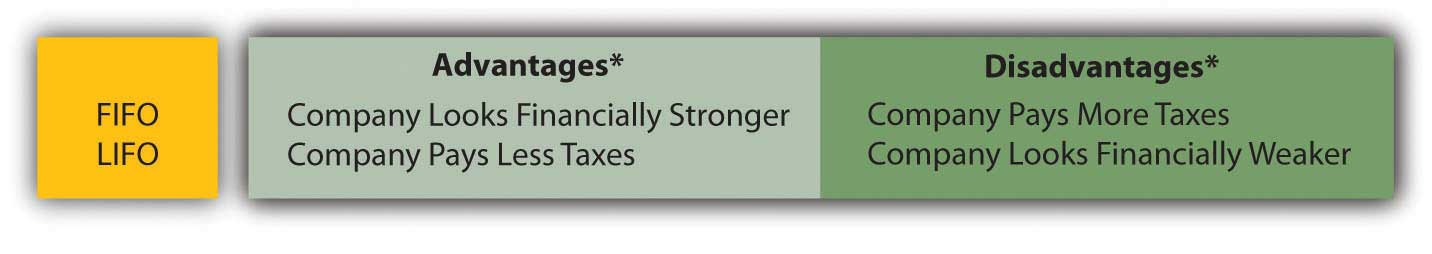

The Pros and Cons of LIFO vs FIFO in Inventory Valuation

The principles of FIFO are intuitive and mimic the natural flow of inventory, making it a method that can be easily understood and applied across various sectors. Aided by inventory software, the simplicity of FIFO helps reduce errors and enhance operational efficiency. First In First Out inventory control can revolutionize how your warehouse operates, reduce waste, improve customer service, and drive better performance from your warehouse.

What Types of Companies Often Use LIFO?

This can create a mismatch between revenues and expenses, making it challenging to assess true profitability. Investors and analysts must be aware of these nuances when interpreting financial statements prepared using FIFO. It’s recommended that you use one of these accounting software options to manage your inventory and make sure you’re correctly accounting for the cost of your inventory when it is sold.

FIFO vs. LIFO Inventory Valuation

This means that you are then faced with more taxes because tax obligations are tied to your business profits. The LIFO cost flow method of inventory reporting is not permitted under the tax laws of many countries, such as the United Kingdom, Australia, and New Zealand. This is because LIFO potentially distorts or artificially lowers a company’s profitability and financial reporting.

FIFO helps businesses to ensure accurate inventory records and the correct attribution of value for the cost of goods sold (COGS) in order to accurately pay their fair share of income taxes. In the retail sector, especially in grocery stores, the FIFO method is indispensable for managing perishable goods. By prioritizing the sale of the oldest produce, stores can avoid wastage, maintain product freshness, and minimize losses due to spoilage. This approach ensures that customers receive quality products and helps businesses optimize their inventory turnover rates.

As an operations professional, you understand the critical role of efficient inventory management in the success of any business. FIFO can be useful during periods of inflation when higher profits may positively affect investor perception. On the other hand, LIFO shows reduced profitability, which can provide tax advantages, in particular short-term tax relief. Whereas absorption costing and variable costing explained FIFO assumes that the oldest items added to inventory are the first sold, LIFO assumes that the most recently acquired inventory is sold first. The construction and building materials industry benefits from FIFO as well. In managing a wide variety of inventory needed for projects, FIFO helps prevent a buildup of materials that might deteriorate over time.

It’s also the most widely used method, making the calculations easy to perform with support from automated solutions such as accounting software. Throughout the grand opening month of September, the store sells 80 of these shirts. All 80 of these shirts would have been from the first 100 lot that was purchased under the FIFO method. To calculate your ending inventory you would factor in 20 shirts at the $5 cost and 50 shirts at the $6 price. So the ending inventory would be 70 shirts with a value of $400 ($100 + $300).

The “inventory sold” refers to the cost of purchased goods (with the intention of reselling), or the cost of produced goods (which includes labor, material & manufacturing overhead costs). First In First Out (FIFO) is one of the cost formulas that help cost assignment for inventory valuation. Entities can easily use FIFO with periodic or perpetual inventory systems. The First In, First Out FIFO method is a standard accounting practice that assumes that assets are sold in the same order they’re bought. All companies are required to use the FIFO method to account for inventory in some jurisdictions but FIFO is a popular standard due to its ease and transparency even where it isn’t mandated.

This method minimizes waste, prevents product obsolescence, maintains accurate cost calculations, and enhances inventory valuation. FIFO ensures that the ending inventory values on the balance sheet are indicative of current market prices for the items. As items purchased at earlier dates are pulled from inventory for production or retail sale, the inventory on the books at the end of the month consists of more recently purchased inventory. This ensures that the ending inventory on the balance sheet is reflective of current market prices.

While LIFO also impacts a company’s financial health and tax obligations, LIFO differs significantly in regard to accounting practices and financial reporting. Manufacturing companies apply FIFO in managing raw materials and finished goods. This ensures that materials bought first are used in production before newer ones, aligning with demand patterns and reducing the risk of stock obsolescence.